connecticut sports betting tax rate

How To Book Sports Betting. An 18 tax rate for the first five years for any online casinos if legislated for followed by a 20 tax rate for at least the next five years.

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

As for the state as a whole it expects to draw in 30 million in the first year eventually ramping up to.

. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by a 20 tax rate for.

Taxes and fees for sports betting and iGaming. The sports betting tax rate for CT is 1375 Connecticut lottery can take up to 15 retail sportsbooks Bettors cannot place wagers on Connecticut college sports teams. Connecticut Legal Online Sports Betting Tax Rate.

56 Colorado Sports Betting Tax Rate. Both sports betting and online gambling would be limited to those 21 and older. 59 Florida Sports Betting Tax Rate.

58 Delaware Sports Betting Tax Rate. Winnings earned as a result of gambling must be reported for tax reasons. Legalising Betting In Sports In India.

A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by a 20 tax rate for at. The deal also calls for a separate 1375 tax rate on sports betting. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering.

The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate. The Law Regulations and Technical Standards for all forms of Online Gaming. 600 plus 5 of the excess over 20000.

Sports betting tax rate. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal. MOU Amendment - July 2021.

The Connecticut General Assembly has. 10 online 8 retail. Proceeds will go to a college fund to allow students to attend.

57 Connecticut Sports Betting Tax Rate. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. After two months under 1 billion in online New York sports betting handle Empire State operators bounced back in.

Aside from the 20 tax the state would collect from online casino games it would collect a 1375 tax on sports bets placed with the casinos online or in person rates that the. How Do Odds Work Sports Betting. 31 rows Since the inception of legal sports betting in 2018 the Garden State has collected 1695.

32 rows How States Tax Sports Betting Winnings. If you are married and file jointly or you are a qualifying widow er this is your tax schedule for 2021. 1 day agoThe NFL is back and with it so is NY sports betting.

Connecticut sports betting apps pay a 1375 revenue tax. A 1375 tax rate on online and land-based sports. Las Vegas Odds Sportsbook Lines And Sports Betting Trends At.

The legislation is Public Act 21-23.

Connecticut Sees Revenue Upticks In Sports Wagering Igaming

Connecticut Icasino Sports Betting Numbers Grow

Is Online Sports Betting Legal In Connecticut

Tax Foundation Connecticut Has Second Largest Tax Burden In The Country Yankee Institute

New York Takes A Gamble With 51 Tax On Online Sports Betting

New York Now Leads Nation In Mobile Sports Betting The New York Times

Connecticut House Approves Sports Betting Deal With Tribes Ict

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Major Step As Ct Sports Betting Agreement Includes Both Gaming Tribes

Sports Wagering 2019 State By State Guide Insights Holland Knight

Sports Betting Tax Treatment Sports Betting Operators Tax Foundation

Connecticut Sports Betting Operators Beat Out Their Bettors In August

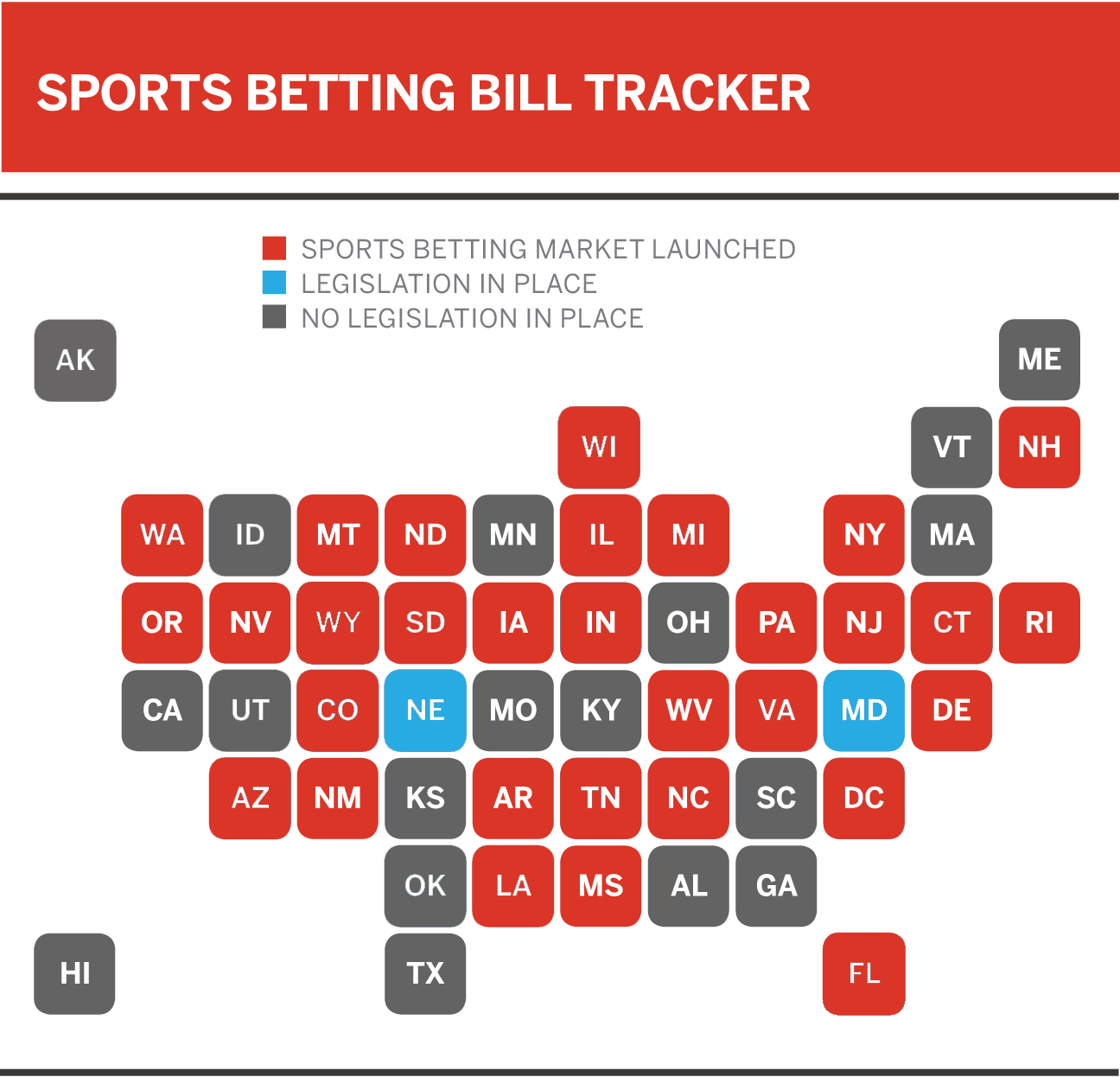

The United States Of Sports Betting Where All 50 States Stand On Legalization

Online Sports Betting Is Live In Connecticut Ctinsider

Would Hawaii Really Issue A 55 Tax Rate On Sports Betting

Connecticut Reports 16 Million In Sports Betting Revenue In First Full Month

Online Sports Betting S N Y Debut 2 4 Billion In Wagers In 5 Weeks The New York Times

Online Gaming Sports Wagering Legalized In Ct Fox61 Com

Ct House Of Representatives Passes Legislation Regarding Online Gaming Sports Betting In State Fox61 Com